In Leeds, Simon Goulding, who is about to buy his first home, has noticed how quickly the mortgage market is changing.

In April, he was offered a loan worth 26 per cent of the value of the home, fixed for five years, at 4.9 per cent. Last week, after finding the right property, he could get a 37 per cent mortgage, fixed for five years at 4.05 per cent.

“I just want to get the deal done quickly,” says Goulding, who’s happy with new rates being offered and keen not to let the home slip through his fingers.

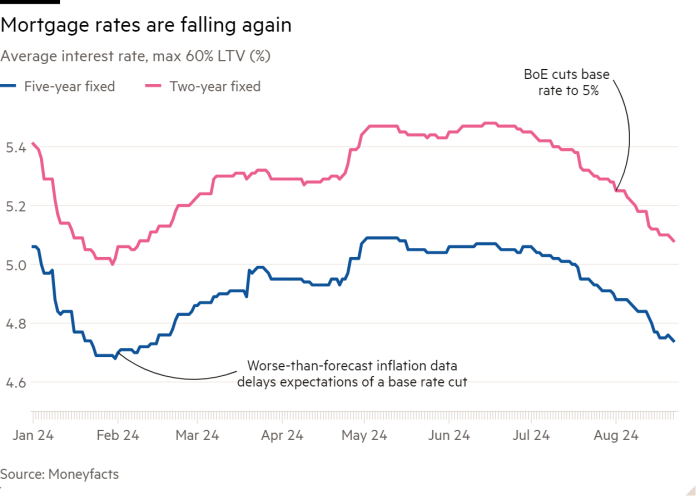

He’s not the only one with a newfound sense of urgency. Since the Bank of England cut the base rate to 5 per cent on August 1, the number of buyers contacting estate agents through Rightmove is up by a fifth year-on-year, and major mortgage lenders have been slashing rates — in some cases multiple times. This week, Nationwide, TSB, Barclays and HSBC all announced further cuts to their headline rates, as the price war between lenders intensified.

Three months ago, the best five-year fixed rate mortgage on the market for purchases up to 75 per cent loan to value (LTV) was 4.44 per cent, according to Moneyfacts. On Thursday, it was 3.94 per cent.

On a £750,000 mortgage, with a 25-year term, that would mean a cut in monthly payments of more than £200.

“Borrowers may find they can afford larger mortgages, too, since banks calculate their affordability criteria on many products using their standard variable rates, which have fallen since the BoE decision,” says Ray Boulger, senior technical manager at mortgage broker John Charcol.

But will this inject any life into the UK’s property market? Or will the underlying affordability constraints keep buying and selling subdued for some time to come?

Falling mortgage rates are already changing what buyers are borrowing. Mike Boles, head of private office at Savills Private Finance, says variable rate products have long been popular with wealthy homeowners because they allow fee-free early repayments in the event of a work bonus or a windfall from the sale of investment assets.

“But since August 1, fixed-rate deals have become so attractive that many clients have been calling me to discuss switching,” he says.

City trader Jonathan has just bought a home in the capital for £2.5mn, porting a £1mn variable-rate mortgage he has had since December. He believes mortgage rates will go lower but is currently applying for a five-year fix at 3.84 per cent with HSBC — an offer he will take immediately if he thinks rates could climb again.

“Currently, I’m waiting, but there’s still an inflation risk. So if sentiment turns, I’ll hear about it first because of my job, and I’ll dive in and fix for five years,” says Jonathan, who declined to give his real name.

“When rates get into ‘the 3s’ wealthy people figure: after tax I can make more than that on my money, so it’s sensible to borrow again,” says Simon Gammon of Knight Frank private finance.

There’s another reason too, he adds. “With the new Labour government showing clear intent to increase taxes, there’s a real concern that inheritance tax will rise. Borrowing on your home, which reduces the amount subject to IHT when you die, makes more sense,” he says. The government’s tax plans will be revealed in the chancellor’s first Budget, on October 30.

In the mainstream market, with buyers expecting rates to come down, the appeal of two-year fixes has grown while that of five-year fixes has waned. In July, 55 per cent of John Charcol clients took a two-year fix; with only 30 per cent opting for a five-year.

Sam Thompson and his partner, who both work remotely and can live anywhere in the UK, are looking to buy their first home in Glasgow, borrowing up to £250,000 to buy a property for up to £300,000. While they would appreciate the lower rate they would get from a five-year mortgage, they favour the greater flexibility of a three-year product, he says. “We’re not necessarily committing to living there forever. It will be easier to move without taking the mortgage with us,” he says.

But how long the preference for shorter fixes will last is unclear, says Andrew Montlake, managing director at Coreco, a mortgage broker. He says that since August 1 and in light of recent cuts by major lenders, many more customers have been inquiring about five-year deals — a route he believes is the most sensible. Swaps markets, which is how lenders price their fixed-term deals, predict the base rate will be 3.5 per cent in two years.

“So the two-year fix strategy means that if lenders pass on future bank rate cuts, if there’s no spike in inflation, and if we don’t have another Liz Truss-style domestic mess-up, you save in the long term,” says Montlake. “That’s a lot of ifs.”

“The downside of taking the shorter term is getting the decision wrong,” says David Wise, a high-end mortgage broker based in London. “Locking in for longer means knowing what your future payments are — even for [very rich] clients that’s valuable.”

Entrepreneur Will Clarke, 27, and his partner have just moved into their first home in Kent, borrowing 85 per cent of the purchase price. With the financial uncertainties of running two businesses, he favours the predictability of a five-year fixed-rate mortgage, especially since he is unsure whether mortgage rates will fall.

“This way I know, regardless of what happens, I can afford the payments,” he says. “Yes, we could have waited for mortgage rates to come down, but they could go up, meaning [our mortgage] would cost more in the long run.”

Estate agents certainly expect lower rates to kick start a late summer surge. Sharon Hewitt, who runs Chiltern Relocation, a Buckinghamshire buying agent which specialises in customers relocating to high-value homes from London, says she has received significantly more inquiries since August 1.

“With the election out of the way, people have greater clarity, and the rate cut has signalled a more optimistic economic outlook,” she says.

“It’s put a foundation under the market and encouraged [buyers] to commit to purchases,” says Henry Pryor, a UK buying agent, who helped clients exchange on two homes for £6.5mn in the week following the BoE’s decision. “Buying feels less risky after [the cut],” he says. “The wider economy looks more stable which should mean house prices are more predictable, and job security looks more assured.”

On August 8, the Royal Institution of Chartered Surveyors said its monthly survey of estate agents pointed to “a meaningful pick-up in sales volumes going forward” in July, with more respondents expecting both sales and prices to rise in the near term and over the year ahead.

House prices have increased by 1.4 per cent in the year to July, compared to one year earlier, according to Zoopla, which predicts an annual gain of 2.5 per cent in 2024. As recently as November, when the average two-year fixed rate mortgage cost 6.29 per cent, Zoopla was forecasting a 2 per cent fall in house prices in 2024.

Richard Donnell, head of research at Zoopla, says the market is on track for 1.1mn home sales this year, 10 per cent higher than 2023.

Interest had been building in the weeks leading up to the rate cut, says Montlake. “In popular areas we were already seeing increased demand”. In July, one of his clients was among five submitting ‘best and final’ offers for a family house in Fulham, two days after it came to market for £1.85mn; the client bid £1.95mn and the home sold for £2mn.

“A year ago, there is no way he would have bid for that home . . . mortgage rates were just too high,” says Montlake.

For other buyers, the recent bank cut has caused them to shelve their plans to buy, and instead hold out for better deals. In January, Heather Cazemier and her husband, who own several other homes in London, secured £700,000 on a five-year fix at 3.94 per cent, to buy a £1.285mn flat in Canary Wharf.

At the last minute, when the couple discovered mandatory work to the building could cost them a further £100,000 in the coming years, they pulled out.

“[Interest rates] are now headed in the right direction. I’m glad we didn’t go through: we’d be stuck for five years paying more than if we’d waited for six months or a year,” she says. She and her husband have put their home search on hold, and may not buy at all.

But judging by swaps market pricing and the anticipated timing of future rate cuts, there is a limit to how low mortgage rates will go in the next two years.

“We are certainly not going to return to the levels we had before this latest interest rate tightening cycle,” says Andrew Goodwin, chief UK economist of Oxford Economics, who believes mortgage rates will stabilise around 4 per cent by 2027, by which time, he predicts, the bank rate will be 2 per cent.

“The jury is out on how much lower mortgage rates will fall by the end of the year, and much depends on the outlook for inflation and base rates,” says Donnell.

For large swaths of current or prospective homeowners, that won’t do much to make homes more affordable, limiting the prospects of a summer surge in home buying.

“Yes, in relative terms, buyers are slightly better off than when rates were at their peak, but there is still a massive gulf between house prices and earnings,” says Cara Pacitti, senior economist at the Resolution Foundation, a think-tank.

Despite the ratio falling from its peak in 2021, house prices remain 8.3 times average earnings for full time workers in England, according to the ONS.

For first-time buyers, rising rents — up 5.7 per cent in the year to June, according to Zoopla — and high inflation are eating into deposits and draining savings opportunities created by rising wages.

“So, even if mortgages get more affordable, scraping together enough for a deposit [remains] a real constraint. A big chunk of the population is still very far away from getting on the housing ladder,” says Pacitti.

Agreed sales in the week following the rate cut were up 5 per cent year-on-year, but have since returned to levels of a year ago, according to Donnell.

“We’ve still got some big affordability constraints there,” he says. “I don’t think this is an inflection point or that we’ll look back and say: wow, look what impact that base rate cut had on sales.”